Table of Content

Angela Colley writes about real estate and all things renting and moving for Realtor.com. Her work has appeared in outlets including TheStreet, MSN, and Yahoo. 1Based on Rocket Mortgage data in comparison to public data records. How To Assess Your Finances And Calculate What To Spend Home Buying - 10-minute read Miranda Crace - October 25, 2022 Home buyers often wonder how much house they can afford. It’s to your advantage to aim for a DTI of 50% or lower; the lower your DTI, the better chance you have at being offered a lower interest rate.

Different lenders accept different LTV ranges, but it’s best if your ratio is 80% or less. If your LTV is greater than 80%, you may be required to pay a form of mortgage insurance . Keep in mind that this varies by loan type and some loans, like VA loans, may allow you to finance the full purchase price of the house without you having to pay mortgage insurance.

Keep Your Credit Utilization Low

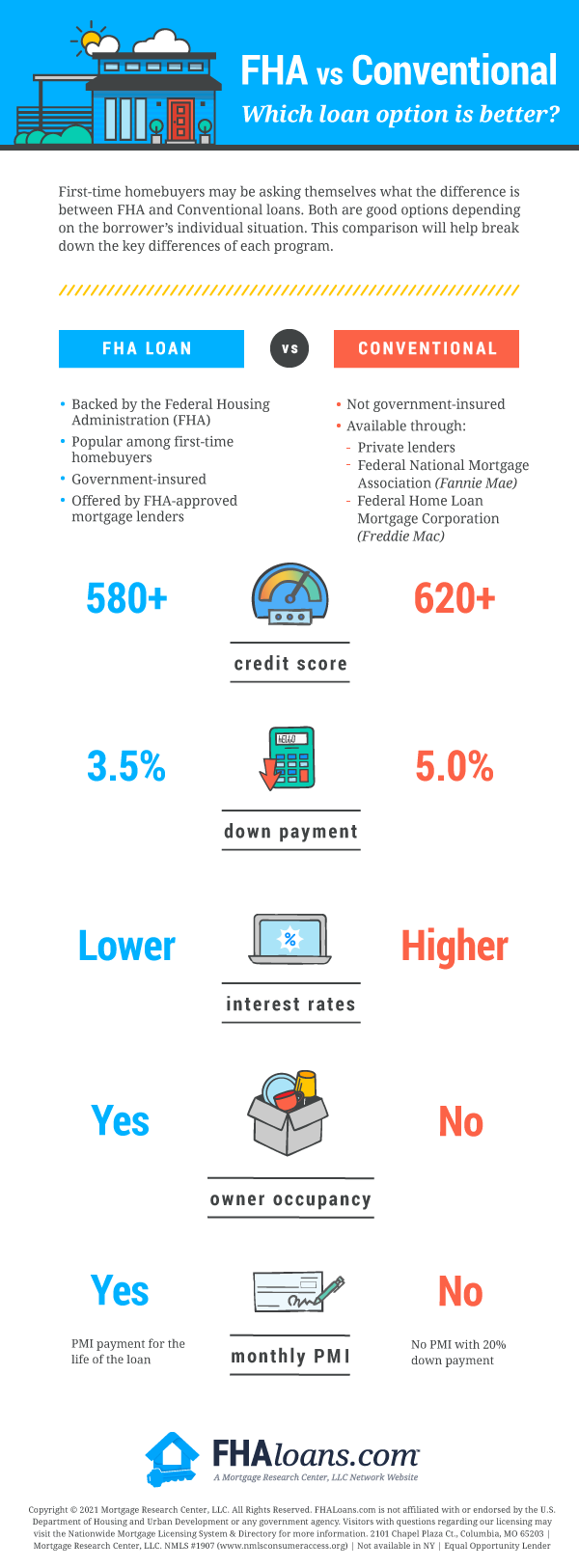

Mortgage pre-approval letters are typically valid for 60 to 90 days. Lenders put an expiration date on these letters because your finances and credit profile could change. When a pre-approval expires, youll have to fill out a new mortgage application and submit updated paperwork to get another one. Builders for new construction often require conditional loan approval before beginning the process. Most likely, you cannot start building a new home without conditional loan approval. With the 620 credit score on a conventional loan, in today’s market, you’d get an interest rate of about 3%.

Putting more money down makes you seem like a less risky borrower and can also help youscore a lower interest rate. VA loansare backed by the Department of Veterans Affairs, and are offered to active-duty military service members, veterans, and their surviving spouses. How does your credit score affect your chances of getting a home loan? Lenders in Australia don’t make their credit criteria public, and most lenders also don’t rely credit score alone to determine your level of credit risk. That said, the higher your credit score, the better your chances of getting loan approval.

Manage Your Mortgage

There are other home loans out there that will require you to have a higher credit score. For example, if you’re taking out a jumbo loan, you’re taking out a loan that’s outside of the maximum agreed limits. This is arguably the most important part of your credit score.

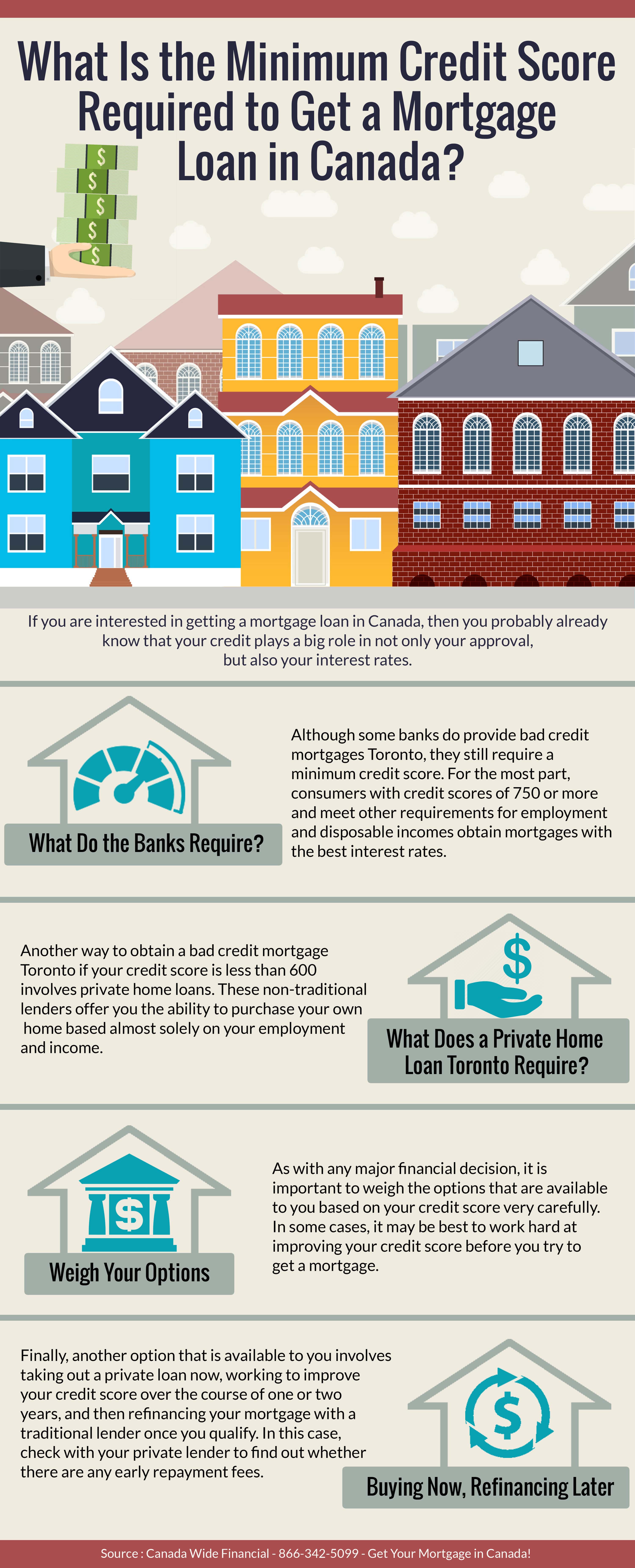

Qualifying for a mortgage because it shows the lender you’re likely to repay your loan on time. The bank’s lending policy plays a role; some banks may be willing to approve an even lower credit score. Remember, when applying for a mortgage make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit. You may not have a large credit history, which will affect you when you’re looking for a home loan.

The Buyers Credit Score Dropped Below The Minimum

We don't own or control the products, services or content found there. You’re entitled to a free credit report from all three major reporting agencies once a year. Learn about mortgage preapprovals and how they can help you get into the home of your dreams faster. A higher LTV is riskier for your lender because it means your loan covers a majority of the home’s cost. This is the closest thing there is to a mortgage for bad credit.

On-time payments are crucial to getting a high score, so you’ll want to ensure all your payments are on time. These are a few of the loans that are available to you, should you have a lower credit score. It shows that even if you have a lower score, homeownership is not out of reach. Typically, you will need a credit score of 640 in order to qualify for a USDA loan. If your credit score is lower, then the loan will need manual underwriting. These loans are backed by the US Department of Agriculture, and helps buyers looking to buy in rural areas.

What’s A Good Credit Score To Buy A House?

That’s because lenders think you’re less likely to stop making your payments if you’ve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders. We said, most lenders – including Rocket Mortgage – require a minimum credit score of 620 for a conventional mortgage. As mentioned, if you’re worried about your credit score, try to apply to multiple banks with ooba Home Loans, and give yourself the best chance of approval. That’s why lenders want to issue these loans to people with credit scores of 700 or higher.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620. There are two different types of personal loans – secured and unsecured. Learn which one is best for you and how they impact your credit score. This is where the “positive” in positive credit reporting comes in.

Presents you with a comprehensive credit report and financial history to assess your current financial situation and credit score. You also could add a co-signer with strong credit to your mortgage application, which will improve your chances of getting approved. Just remember that co-signers assume legal responsibility for the loan if you fail to repay it. That means if you have trouble making your payments, your co-signer will be legally obligated to pay the loan. Nonconforming loans cannot be sold to Fannie or Freddie, and the minimum required credit score is up to the individuallender.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model. Before we get into the credit score you need to qualify, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different bureaus.

The pre-approval process is simply a way of understanding the debt you’ll be taking on and determining whether you’ll be able to handle the financial strain a mortgage puts you under. It’s also a way of knowing your true price range and showing your lender that you are serious about buying a home. Borrowers will also have to undergo a stress test during the mortgage approval process. If you’re worried you don’t have the credit score for a mortgage, one thing you can do is chat with a lender to learn more about where you’re at.

If you have a score of 5% or above, then you can get a loan, but you’ll need to put down a deposit of 10% or more. That deposit can be made using a gift from a friend or family member, savings, or a grant for down payment assistance. If you have a lower credit score, you can still get a home loan. Your credit report won’t show any other information, such as your age, income, or length of employment. If you keep making applications, that will ding your credit history, so be aware of this. It’s typically seen as a red flag if you’re using the maximum amount of credit that you have available to you.

No comments:

Post a Comment